Protect my Credit Card!

Protect my Credit Card! a reader asks…

Protect my Credit Card! a reader asks…

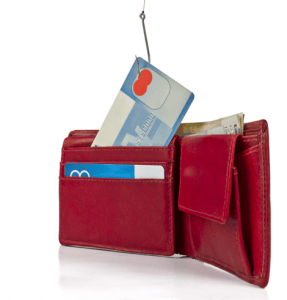

I’m concerned about all the news reports say this company or that got their computers hacked and lost millions of credit card accounts. Can you give me some simple steps I can take to protect my credit card accounts?

Certainly! There are a number of steps you can take, depending on what you have available. The most basic is to review your statement as soon as you receive it. If you see any transaction you don’t recognize, you should immediately contact your issuing bank and dispute the charge. Be sure to check with any other cardholders first though, so you don’t dispute that purchase made by your spouse!. And don’t ignore the small value transactions – hackers often fraudulently make sub-dollar transactions to ‘test the waters’ and see if anyone’s watching. If these small transactions get through without raising an alarm, they’ll follow up with a big one.

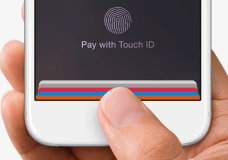

If you use online banking and/or if your issuing bank offers this feature, you should elect to receive email or text message notification every time your credit card is used. If you have a smartphone or tablet, you can download an app from the issuing bank and see all your transactions at a glance (and this may offer instant notifications as well). If you use an iPhone 6/6Plus, you can register your credit card with Apple Pay – even if you don’t use Apple Pay, you’ll get notified every time your credit card is used. Let’s see if the forthcoming Samsung Pay gives you the same benefit, same for Google Wallet.

If you use online banking and/or if your issuing bank offers this feature, you should elect to receive email or text message notification every time your credit card is used. If you have a smartphone or tablet, you can download an app from the issuing bank and see all your transactions at a glance (and this may offer instant notifications as well). If you use an iPhone 6/6Plus, you can register your credit card with Apple Pay – even if you don’t use Apple Pay, you’ll get notified every time your credit card is used. Let’s see if the forthcoming Samsung Pay gives you the same benefit, same for Google Wallet.

The important point here is that you need to watch your transaction history like a hawk, using whatever method you have available. If you have a smartphone and your issuing bank doesn’t offer an app that notifies you of every transaction, you should either contact them and request that feature, or start shopping for a new credit card.

The important point here is that you need to watch your transaction history like a hawk, using whatever method you have available. If you have a smartphone and your issuing bank doesn’t offer an app that notifies you of every transaction, you should either contact them and request that feature, or start shopping for a new credit card.

And don’t think that the spiffy new credit card with a chip you just got from your bank is going to really change the game. These cards are primarily to protect banks by pushing liability for fraudulent use onto merchants. Since either way consumers end up paying for fraudulent use of credit through higher prices, this doesn’t do more than pay lip-service to reducing credit card fraud. Just my opinion…

And don’t think that the spiffy new credit card with a chip you just got from your bank is going to really change the game. These cards are primarily to protect banks by pushing liability for fraudulent use onto merchants. Since either way consumers end up paying for fraudulent use of credit through higher prices, this doesn’t do more than pay lip-service to reducing credit card fraud. Just my opinion…

This website runs on a patronage model. If you find my answers of value, please consider supporting me by sending any dollar amount via:

or by mailing a check/cash to PosiTek.net LLC 1934 Old Gallows Road, Suite 350, Tysons Corner VA 22182. I am not a non-profit, but your support helps me to continue delivering advice and consumer technology support to the public. Thanks!