Why Apple Pay will win!

Why Apple Pay will win! Now that the iPhone 6 and 6 Plus are widely available and in the hands of millions of consumers, more and more banks and retailers are jumping on the Apple Pay bandwagon. But there are still some big-name holdouts in the retail sales world, most of the one’s who signed up for CurrentC, a retailer-led payment alternative to regular credit/debit card use. Here’s why I think I think CurrentC will fail, and why Apple Pay is so much superior to every other method you might use to pay for something.

Why Apple Pay will win! Now that the iPhone 6 and 6 Plus are widely available and in the hands of millions of consumers, more and more banks and retailers are jumping on the Apple Pay bandwagon. But there are still some big-name holdouts in the retail sales world, most of the one’s who signed up for CurrentC, a retailer-led payment alternative to regular credit/debit card use. Here’s why I think I think CurrentC will fail, and why Apple Pay is so much superior to every other method you might use to pay for something.

First, CurrentC is an initiative fronted by big-name retailers to replace credit card use by having smartphone users scan a QR code and continue through a process at the retailer to complete a purchase. Clunky and more work than just swiping a credit or debit card, CurrentC’s primary goal appears to be avoiding those hefty credit card fees that retailers have to pay, while capturing more of a shopper’s identity for marketing. Just my opinion, but this non-consumer-friendly payment method is doomed from the start.

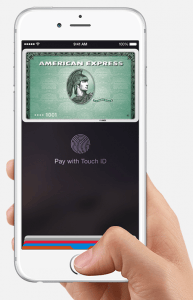

Conversely, Apple Pay is actually easier to use than swiping a credit card (in most cases). Everyone’s already heard about the fancy fingerprint ID built into the iPhone 6 and 6 Plus which, along with Near-Field Communications (NFC) is what makes Apple Pay so darn easy to use. Really, all you have to do is put your finger on your iPhone’s Home button (you don’t even have to press), and tap it against the credit card terminal. You don’t even have to wake the iPhone up, NFC recognizes the credit card terminal and your fingerprint, and sends information to the retailer.

That’s all well and cool, but here’s the real secret weapon – the retailer never gets your credit card information! All other payment methods using a credit or debit card give your card info to the retailer (your credit card number, expiration date, name, billing address, etc.). The retailer of course sends this on to their payment gateway who communicates with your bank to get authorization for the transaction. This all occurs between the time you swipe your card to the time you sign for the purchase. With Apple Pay, everything is exactly the same except the retailer only gets a one-time transaction code – not your credit card or identity information. Even better, the Passbook app on your iPhone doesn’t have your credit card information either, just a Device Account Number and the last 4 digits of your credit card number. Apple works this apparent magic by creating a one-time code with your Passbook, your fingerprint reader and the credit card terminal.

What makes this so awesome is that if (no when!) the retailer’s computer systems get hacked, they only have a one-time code which will never work again. Hackers won’t be able to see your credit card and identity information. Neither can Apple, since Passbook doesn’t have keep your credit card information, just a Device Account Number. What makes this so powerful is that virtually any other way you pay for something, you are giving up something valuable:

Pay with cash and you part with the folding green, the chance of getting a refund is non-existent, and there is really no buyer protection. If your cash is stolen, it’s gone.

Pay with cash and you part with the folding green, the chance of getting a refund is non-existent, and there is really no buyer protection. If your cash is stolen, it’s gone.- Pay with a credit or debit card (swipe) and all your credit and identity information is captured by the retailer, ready to be lost to hackers. If stolen, your card info is usable by thieves till you report it.

- Pay with a new chip-and-signature credit or debit card and all your information is still captured by the retailer, but safer transactions with a unique transaction code (not so if you swipe the card normally). If stolen, your card info is usable by thieves till you report it.

- Use Google Wallet and Google has all your information, since they have your credit card info. Think they’ll never be hacked?

What makes this so devastating to retailers is that they are denied all the marketing data that comes with the transaction, who you are and what you bought. To retailers, that information is incredibly valuable for marketing. Fortunately for retailers, they have gift cards, newsletter signups, and tons of other ways to get your personal information, so the loss from your use of Apple Pay isn’t complete. I think the big-name retailers who are fighting against Apple Pay should just drop this losing battle and figure out how to maximize their buyer loyalty programs within this new world of virtual payments.

Apple has always been great at taking existing technologies (like NFC and fingerprint readers) and repackaging it in a way to create a user experience far better than the competition. Google Wallet has been around awhile but never really took off because the user experience was more work than swiping a credit card. Apple Pay is at least as easy as a swipe (or easier), and much more secure.

Of course you’re going to hear folks complain about the security of Apple Pay, and claim that it isn’t foolproof. News flash, nothing is! But Apple Pay with those one-time codes and a bio-metric requirement (fingerprint) is head and shoulders more secure than anything else out there, and is one giant leap forward in consumer protection, for the consumer. But that’s just my opinion.

This website runs on a patronage model. If you find my answers of value, please consider supporting me by sending any dollar amount via:

or by mailing a check/cash to PosiTek.net LLC 1934 Old Gallows Road, Suite 350, Tysons Corner VA 22182. I am not a non-profit, but your support helps me to continue delivering advice and consumer technology support to the public. Thanks!

Pay with cash and you part with the folding green, the chance of getting a refund is non-existent, and there is really no buyer protection. If your cash is stolen, it’s gone.

Pay with cash and you part with the folding green, the chance of getting a refund is non-existent, and there is really no buyer protection. If your cash is stolen, it’s gone.