Home Depot says only Emails were compromised

A reader asks…

A reader asks…

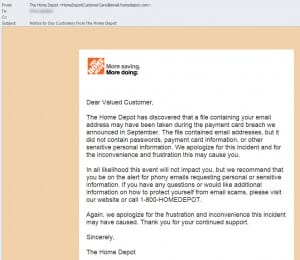

I just got an email from the Home Depot telling me that they’ve been hacked (took them long enough), and their note says only my email was compromised. But I’ve read that the hackers stole payment information including credit card numbers and other identity information. So who do I believe?

I find it sadly kind of funny that you just received this when the breach was broadcast all over the place months ago! Thanks for sending me a copy of the note, I see that although it is legit (actually coming from Home Depot), it’s your basic mass-market form letter. The letter doesn’t even call you by name, just “Valued Customer”. Doesn’t strike me as much value they place in you, waiting months to tell you about it and doing it in such a mindless way. It was probably deemed not worth spending anything on simple form-letter personalization.

So, all the major news outlets have reported on this, saying that 56 million credit and debit cards were compromised. I’m only guessing here, but since the email you got from them was so generic, it lends absolutely no validity to the stated claim that only your email was compromised. That said, you should certainly watch out for phony emails like they suggest. But you should also watch your credit card statements like a hawk, especially any credit card you used at Home Depot. Most credit card companies now offer an enhanced and free service where every time your credit card is used, you get either a text message or email or some notification on your smartphone. Be sure to turn this on at the website of every credit card you own.

And don’t take it personally that you got a generic form email – since hackers are getting away with so much these days, everyone should consider it a given that their credit card and identity information has already been stolen. Businesses are probably spending the majority of their effort on plugging the holes. The smart way to operate these days is to assume such and take steps to watch for and report any suspicious activity on all your bank and credit card accounts. All part of having a safe and healthy digital life in the 21st century – take a look at our checklist here.

If you have an iPhone 6/6 Plus, by all means use Apple Pay anywhere you can, and ask for it everywhere you can’t. And/or Google Wallet. The forthcoming Chip’n PIN credit cards that are (finally!) coming our way over the next 12 months are really too little, too late. It’s high time we all demand the kind of security for our money and credit that you get from these new technologies – namely, one-time transaction codes instead of giving everybody in business your credit card information so it can be hacked.

This website runs on a patronage model. If you find my answers of value, please consider supporting me by sending any dollar amount via:

or by mailing a check/cash to PosiTek.net LLC 1934 Old Gallows Road, Suite 350, Tysons Corner VA 22182. I am not a non-profit, but your support helps me to continue delivering advice and consumer technology support to the public. Thanks!